Microloans

The Philippines

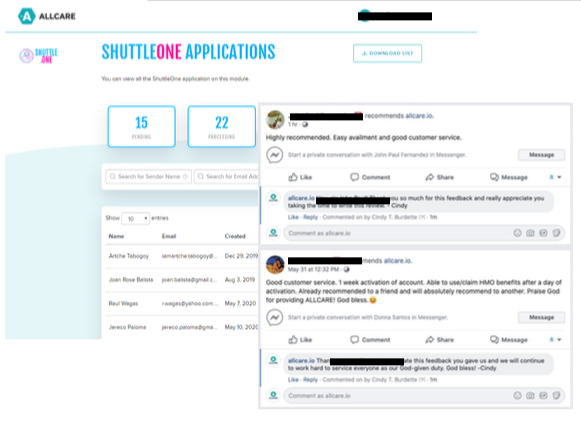

Disbursing microloans to gig economy workers to pay for insurance and benefitsThe Problem

Gig economy workers do not have the standard bank required data to obtain loans Beneficiaries turn to high risk loansharks that charge as high as 60% APRWhat ShuttleOne Do

Allow Allcare.io, a benefits company with a few lines of code to integrate a credit scoring and issue loans to beneficiaries to pay for the insurance benefitsWe connected alternate sources of income (e.g paypal salary receipts) and digitize the financial process via Visage Protocol

The Impact

Gig economy beneficiaries obtain access to capital and insure themselves in under 10minsSME FINANCING

Malaysia

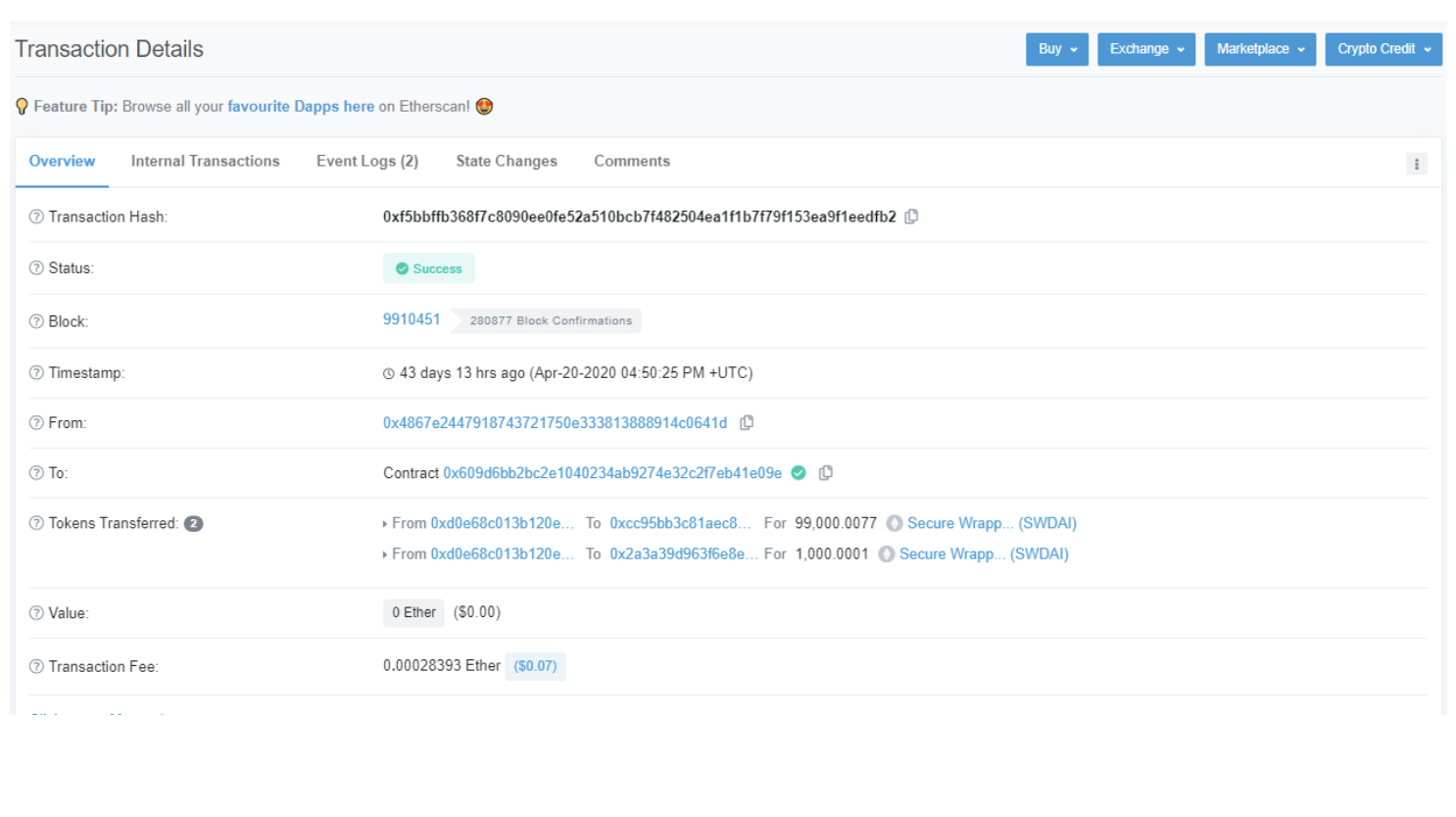

Money transfer for payments of medical supplies to ChinaThe Problem

COVID19 heightened the scramble for medical supplies Merchants are needed to pay in advance to secure stockWhat ShuttleOne Do

Chow Feng International Sdn Bhd, provided trade documentation and the ShuttleOne.Network disbursed a loan in digital currencyMerchant transferred digital currency to settle payments in under 10mins

The Impact

Merchant is more competitive in business with the rapid speed of payments made to suppliersMerchant could not obtain a loan from the banks due to time sensitivity

eCommerce Financing

Singapore

Trade Financing For Ecommerce StartupThe Problem

Merchant faced a uncertain surge in demand in several key markets Local operating bank account needs liquidity for domestic operationWhat ShuttleOne Do

HappyFresh obtained a trade facility in digital currency via trade documentation fed into the ShuttleOne.Network systemsThe Impact

Allowed CFO to have more flexibility in managing cashflows of domestic operations where surge in demand caught by surpriseCOOPERATIVE BANK FINANCING

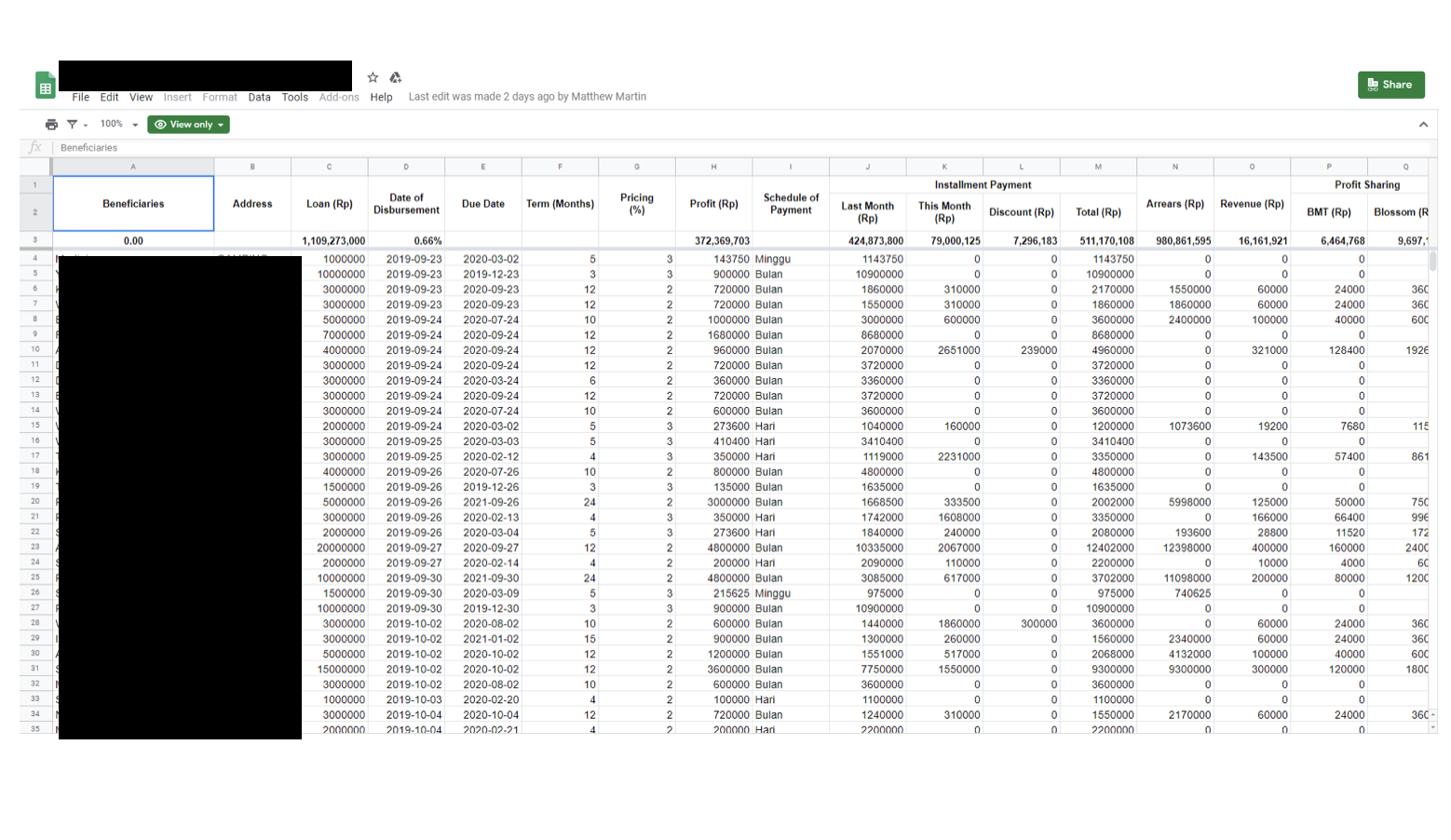

Indonesia

Lending to Cooperative Banks in Indonesia Microloans to Bank membersThe Problem

Cooperative Banks lack digital infrastructure for risk assessmentCooperative Banks generally do not attract capital in terms of deposits for the segment they serve

What ShuttleOne Do

Onboarded ShuttleOne Analytics to perform robust credit scoringDisbursed Microloans for bank members to support domestic trade

The Impact

Cooperative Banks tapped into crypto-Liquidity in digital currencies to service balance sheetsAllowed them to stay unimpacted during COVID19 pandemic